Exclusively For QLD Business Owners Ready To Turn Their Income Into A Home They Love Or An Investment That Builds Their Future — Without Banks Saying 'Not Yet'

You’ve Built A Successful Business — So Why Do Banks Keep Holding You Back? Use End Of Financial Year To Leverage Your Income Strategically — And Unlock The Property Finance You Deserve

By Maximising Tax Efficiency While Structuring Your Income In A Way Lenders Actually Understand — So You Get a Faster 'Yes', With Better Rates, Greater Borrowing Power, And More Opportunities

...Without Needing To Tick Boxes That Don't Apply To Business Owners

If you’re a business owner trying to buy property, you’ve likely realised the banks’ rules don’t fit your reality. You work hard, earn well, and still get told to wait. That’s where we come in.

BusinessPropertyPlanner™ Is The Strategic EOFY Lending Solution Built For Business Owners Who Want To Turn Smart Income Structuring Into Property Approval — Without Delay Or Guesswork

Book Your Private EOFY Lending Strategy Call Now — And See How QLD Business Owners Are Getting Approved Sooner With As Little As 1 Year Of Financials — No Paperwork Headaches, No Bank Runarounds

We Build Strategic Lending Plans For Self-Employed Buyers Who Are Ready To Stop Letting The Bank's Unfair Requirements Hold Them Back...

Implement The Exact EOFY Lending Strategy Helping Queensland Business Owners Secure Property Finance — Even With Just 1 Year Of Financials Or Payslip-Based Income

Your business deserves more than outdated bank rules. This done-for-you finance strategy is built specifically for time-restricted professionals, consultants, and tradies who want to use their income smartly — and move into property months sooner, without paperwork headaches or finance knockbacks.

Here’s Exactly What We Implement For You In The Next 30 Days:

Your EOFY Lending Strategy Session

We kick off with a personalised 15–30 minute planning session to understand your property goals, financial position, and timing.

This isn’t a generic chat — it’s a targeted strategy call designed to uncover what lenders actually need to say yes.

By getting proactive at EOFY, we help you align your income now, before it’s locked in for the year — giving you a serious edge when applying for finance.

Your Early Borrowing Power Estimate

Next, We’ll give you a clear, personalised estimate of your borrowing power before you lodge your return — using the income docs you already have.

This gives you clarity, fast. No more waiting on finalised financials or chasing your accountant for weeks.

You’ll know where you stand now, not months down the track — and can make smarter, faster decisions around property.

Income Alignment With Your Accountant

We collaborate directly with your accountant to structure your income in a way lenders will accept. This is where the real leverage happens.

Whether it’s reworking director wages, adjusting dividends, or timing your lodgement — we ensure your financials are lender-friendly, without compromising your tax strategy.

It’s a strategic move banks won’t suggest, but that can save you months of frustration.

Matched To The Right Lender (Who’ll Say Yes)

Not all lenders view self-employed income the same — so we don’t leave it to chance.

We match you with lenders who specialise in one-year financials or alternative income types like payslips and ABN history.

We manage the entire application process, reduce document overload, and handle the back-and-forth — so you stay focused on your business, not chasing paperwork.

Seamless Approval To Settlement Support

Once approved, we take you all the way through to settlement with minimal admin on your side.

No missed deadlines, no last-minute surprises.

We keep the process on track so you can move into your new home or lock down your next investment sooner — without the stress, the stigma, or the bank’s outdated assumptions holding you back.

From The Desk Of The

Renee Hohenhaus

Founder & Director, I Know The Broker

Self-Employed Property Finance Specialist

The biggest problem business owners face when trying to buy property?

They’re constantly told they don’t tick the right boxes.

Whether it’s “come back when you’ve lodged your return” or “we need two years of financials” — the finance system isn’t built for you. It’s built for PAYG employees with predictable wages and no tax planning in place.

I’ve seen this play out hundreds of times.

A high-performing business owner builds strong revenue, keeps their books clean, even pays themselves a decent income — but when it comes time to apply for a loan, they hit a wall.

Why? Because the banks don't understand self-employed income. They see tax efficiency and smart structuring as red flags… instead of what they really are: signs of a well-run business.

And here’s the truth: it’s not your fault.

You’ve built your income around what's smart for tax — not what makes sense to a junior credit assessor skimming through a spreadsheet.

Most brokers simply don’t have the tools or process to approach self-employed income strategically. And most banks definitely won’t explain it.

And at EOFY? That’s when most business owners either:

A) Lodge without a plan and get locked into a structure that kills their borrowing power for the year, OR

B) Delay the whole thing and miss out on time-sensitive property opportunities

That’s where we do things differently.

BusinessPropertyPlanner™ is built for one thing: helping self-employed Queenslanders use EOFY as leverage — not a limitation.

We team up/collaborate with you (and your accountant) before you lodge to optimise your income and have it work harder for you, identify lender-friendly documents, and connect you with banks who say yes to one year of financials, payslips, or even draft returns.

No fluff. No unnecessary admin. No being treated like a risk just because you own your own business.

We’ve helped business owners move into family homes and investment properties months earlier than expected — with less paperwork, less stress, and no more chasing approvals that were never designed for them in the first place.

So if you’re tired of the finance system working against you — let’s flip the script.

We’ll turn your business income into a weapon — and get you loan-ready while others are still waiting on their accountant to return their emails.

This is EOFY finance done strategically, not reactively.

Let’s get to work.

"We Take This Strategic EOFY Lending Process And Build It Around Your Income, For You"

You don’t need to accept a system that isn’t built for you.

Too many business owners wait years, stuck in houses they’ve outgrown or delaying investments they can easily afford — all because they’ve been told to “wait and lodge another return.”

You work hard. You’ve built real income. But the system doesn’t reflect that — and it’s holding you back.

We build a strategic, lender-friendly plan around your actual income — without asking you to pay more tax, drown in paperwork, or wait until next year.

Could you try to learn the finance system yourself? Work out which banks accept what, guess your borrowing power, lodge your taxes, and hope it all lines up?

Sure. But that comes with stress, delays, and the very real risk of getting it wrong — and missing out on property altogether.

Or you could shortcut all of it by working with a specialist who knows exactly how to turn your business income into loan approval — even if your taxes aren’t lodged yet.

We’ve already built this process. It’s proven. It works.

And we build it for you — so you can secure your property months earlier, with less paperwork, and total confidence.

This is what banks won’t show you.

This is what BusinessPropertyPlanner™ does differently.

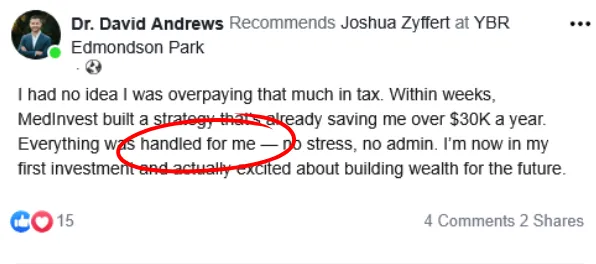

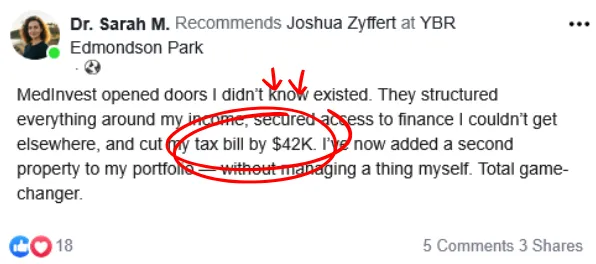

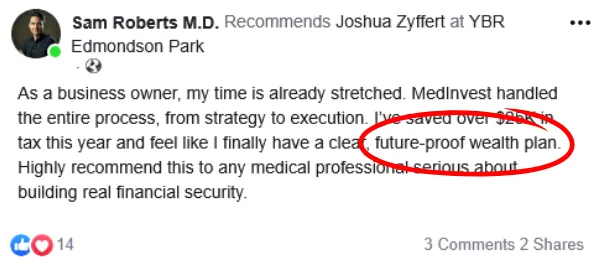

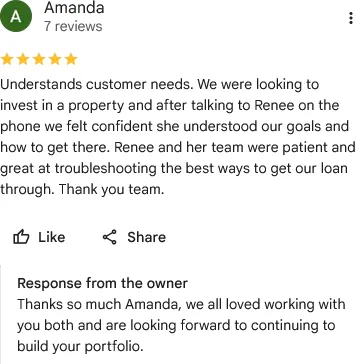

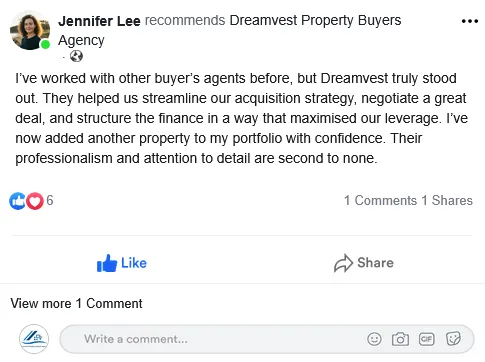

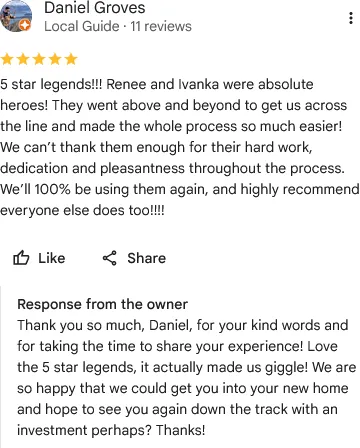

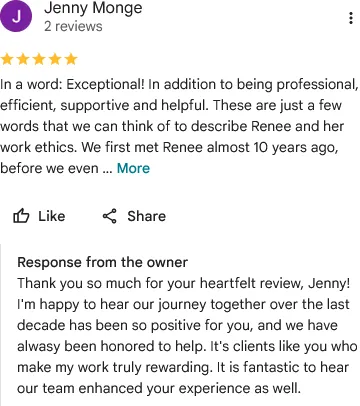

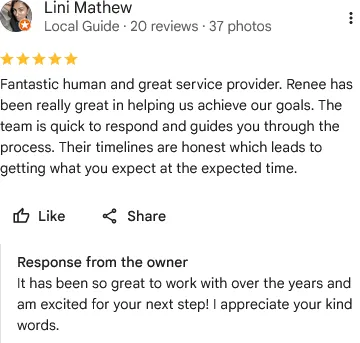

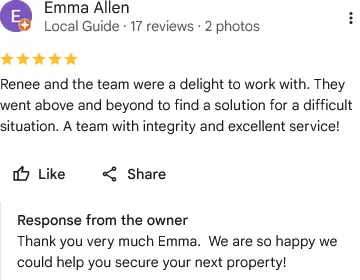

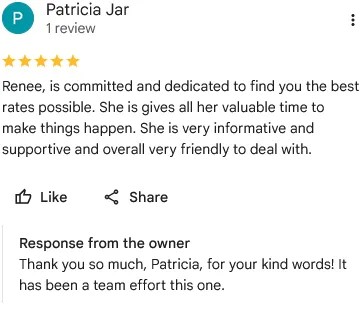

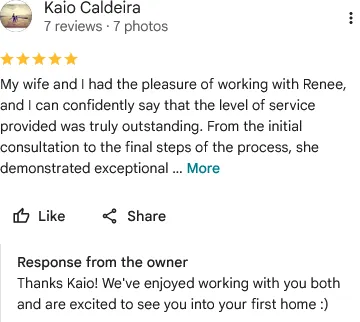

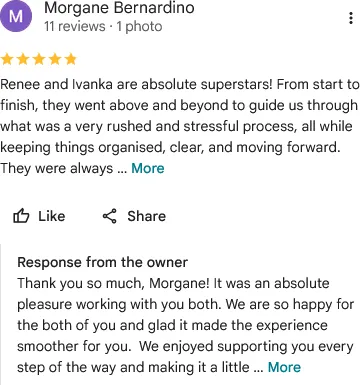

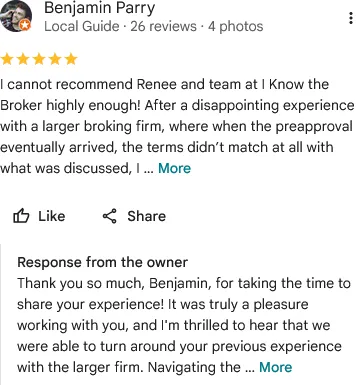

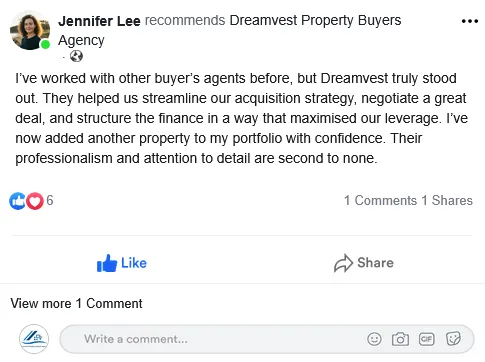

But Don't Just Take Our Word For It....

Execution Case Studies

Approved For A $750K Home Loan With Just One Year Of Financials — After Being Rejected Twice By Their Bank

This Queensland-based tradie had been self-employed for just under two years and was told by two major banks that he’d need to wait another 12 months and lodge a second year of tax returns before he could qualify for finance. He’d structured his income for tax efficiency and assumed that meant the door to home ownership was closed — until he found us.

We stepped in during EOFY, ran a personalised borrowing estimate, then worked directly with his accountant to strategically adjust income prior to lodgement. Using just one year of financials, supported by ABN history and consistent director wages, we matched him with a lender who specialises in self-employed clients.

Not only was he approved — he settled on a $750K family home just seven weeks after our initial strategy call. Minimal paperwork. No credit drama. And zero stress.

This is exactly why BusinessPropertyPlanner™ exists: to help time-poor business owners stop getting penalised for being smart with their income — and finally secure the property they’ve worked so hard for.

We Personally Use This Exact Process To Secure Finance Faster — And Advise Clients With First-Hand, Tested Insight

We don’t just build this system for clients — we use it ourselves. Every strategy inside BusinessPropertyPlanner™ has been battle-tested through our own experience navigating the finance system as self-employed professionals.

We’ve used this exact EOFY strategy — from pre-lodgement planning to lender selection — to secure approvals before financials were lodged, to structure income that meets lender criteria without sacrificing tax outcomes, and to settle property purchases without wasting months in limbo.

We’ve seen where deals fall apart, which lenders make false promises, and which structures deliver consistent approvals. That insider insight is baked into everything we do — so you don’t waste time, miss deadlines, or lose out on the home you’re ready to buy.

When we say we know how to help business owners get approved, we mean it — because we’ve done it ourselves.

"Secure Property Finance On Your Terms — Using A Strategic EOFY Lending System Built For Self-Employed Business Owners"

The key to buying property as a business owner is positioning your income correctly — before tax time hits.

Leverage a proven, done-for-you system that aligns your financials, estimates your borrowing power, and matches you with lenders who say yes to 1-year financials or payslips.

No delays. No dead ends. Just fast-tracked finance tailored to your income — launched in under 30 days.

Learn How To Secure Property Finance Without Two Years Of Tax Returns — Using A Strategic EOFY Lending Plan Built For Business Owners

Take control of your property goals by leveraging a proven system designed for self-employed professionals — even if you’ve only got one year of financials or your tax return hasn’t been lodged.

This process aligns your income, restructures your financials, and connects you with lenders who actually understand business income — helping you qualify for the home or investment property you want, months earlier than expected.

Don’t let the finance system keep you stuck. This isn’t just about getting approved — it’s about finally unlocking the lifestyle and freedom your income should already afford you.

The Strategic End-Of-Financial-Year Lending Process

Your Property Planning

Session

We start with a focused 15–30 minute strategy call to unpack your current financial setup, your borrowing goals, and your timing.

This session is designed to pinpoint what the lenders will need to see and how we can position your income before tax time to put you in the best possible borrowing position — fast.

Your Borrowing Power Snapshot

Next, we assess your available documents — payslips, NOAs, draft financials — and provide a personalised borrowing estimate.

This lets you see exactly what’s possible, right now, without needing to lodge your return or wait on finalised financials. It’s the clarity business owners rarely get from traditional brokers or banks.

Income Strategy Alignment

This is where we collaborate directly with your accountant. We help optimise your income for maximum lender appeal — whether that’s adjusting wages, dividends, or timing your lodgement strategically.

This step is critical in turning your self-employed income into a strength, not a roadblock.

Loan Matching & Application

Once your income is positioned, we match you with lenders who specialise in self-employed finance — including those who accept just one year of financials or payslip-based income.

We manage the entire process, minimise documentation, & handle the admin — so you stay focused on your business.

From Approval To Settlement

Finally, we guide your application through to full approval and settlement.

We stay ahead of key dates, avoid unnecessary delays, and ensure the entire process is smooth, compliant, and aligned to your timeline — getting you into your home or investment property months sooner than expected.

Client Results:

Check Out Some Feedback Provided By Our Clients...

Frequently Asked Questions:

I’ve only got one year of financials — can I still qualify for a loan?

Yes. We work with lenders who accept one year of financials or alternative documentation like payslips or draft returns. You don’t need two full years of tax returns to move forward — and in many cases, we can secure pre-approval before your current return is lodged.

What if I haven’t lodged my tax return yet?

That’s exactly why we built BusinessPropertyPlanner™. We help you before you lodge your return, so we can align your income in a lender-friendly way. Waiting until after lodgement often means missed opportunities or unnecessary delays.

Will this affect my accountant’s tax minimisation strategy?

Not at all. We work with your accountant to balance tax strategy with lender requirements. The goal is to keep your tax position efficient while also unlocking stronger borrowing power. You shouldn’t have to choose one over the other — we help you achieve both.

I’ve been told banks won’t look at me until next year — can you still help?

Absolutely. Many banks operate under outdated lending rules that overlook the self-employed. We know which lenders take a progressive view of income, and we tailor your application accordingly to get results now, not 12 months from now.

How quickly can I get pre-approved?

In many cases, we can deliver a personalised borrowing estimate within 72 hours and secure conditional pre-approval shortly after — depending on documentation. The entire process is designed to move quickly, with minimal friction on your end.

Do I need to provide a mountain of paperwork?

No. One of the key benefits of BusinessPropertyPlanner™ is that we simplify the entire documentation process. We only ask for what’s essential and we manage the back-and-forth with lenders for you — keeping admin to a minimum.

What makes this different from working with a regular mortgage broker?

Traditional brokers often struggle to position self-employed income correctly or simply follow rigid bank checklists. We specialise in working with business owners, understand your financials, and strategically structure them to get fast approvals — even when tax returns aren’t finalised.

Do you work with specific professions or industries?

We work with a range of self-employed professionals across Queensland — including consultants, tradespeople, freelancers, sole traders and company directors. If you run your own business and feel overlooked by traditional lenders, we’re likely a strong fit.

Can this help me buy an investment property, or just a home to live in?

Both. Whether you’re purchasing a family home or building your investment portfolio, we help you maximise your borrowing power and get the right loan in place, without delays or overpaying on interest.

What happens after I get approved?

We stay with you from approval all the way to settlement. That includes liaising with lenders, handling paperwork, and ensuring your timeline stays on track — so you can settle on your property without stress or last-minute surprises.

© Copyright 2025 I Know The Broker. All rights reserved.

Reproduction or duplication of this website or contents is strictly prohibited.

View Privacy Policy & Terms

Disclaimer: Results apply to each person based on their circumstances and current market situation

.